Leveraged & Inverse

What is Leveraged Product?

Leveraged Products typically aim to deliver a daily return equivalent to a multiple of the underlying index return that they track. For example, if the underlying index rises by 10 percent on a given day, a two-time (2x) Leveraged Product aims to deliver a 20 per cent return on that day.

When index daily return rises 1%, product leveraged daily return rises 2%

+1%

+1%

+2%

What is Inverse Product?

Inverse Products typically aim to deliver the opposite of the daily return of the underlying index that they track. For example, if the underlying index rises by 10 per cent on a given day, a negative one-time (-1X) Inverse Product should incur a 10 per cent loss on that day.

When index daily return drops 1%, product daily return rises 1%

-1%

-1% +1%

+1%

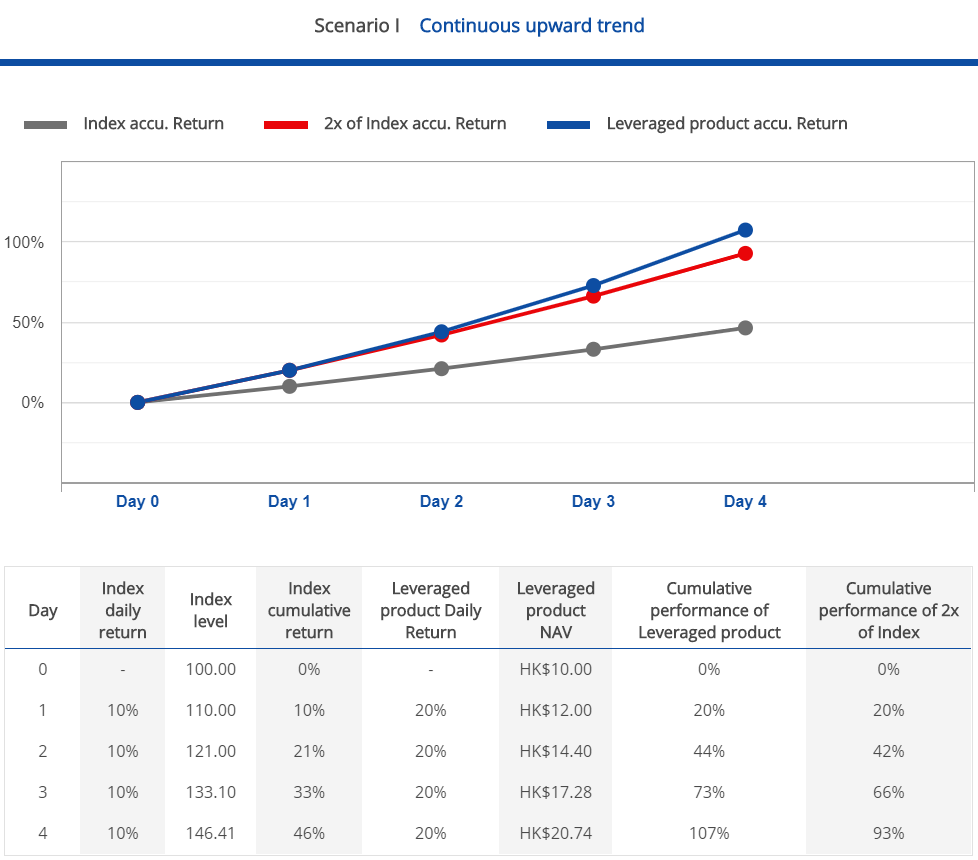

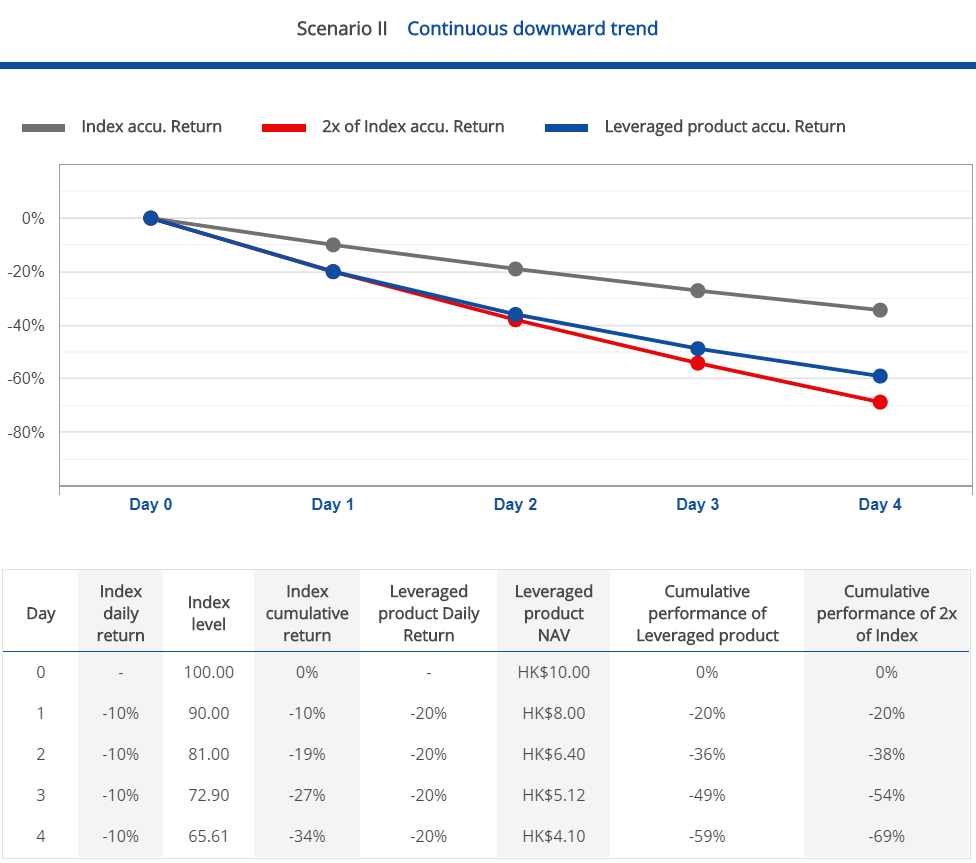

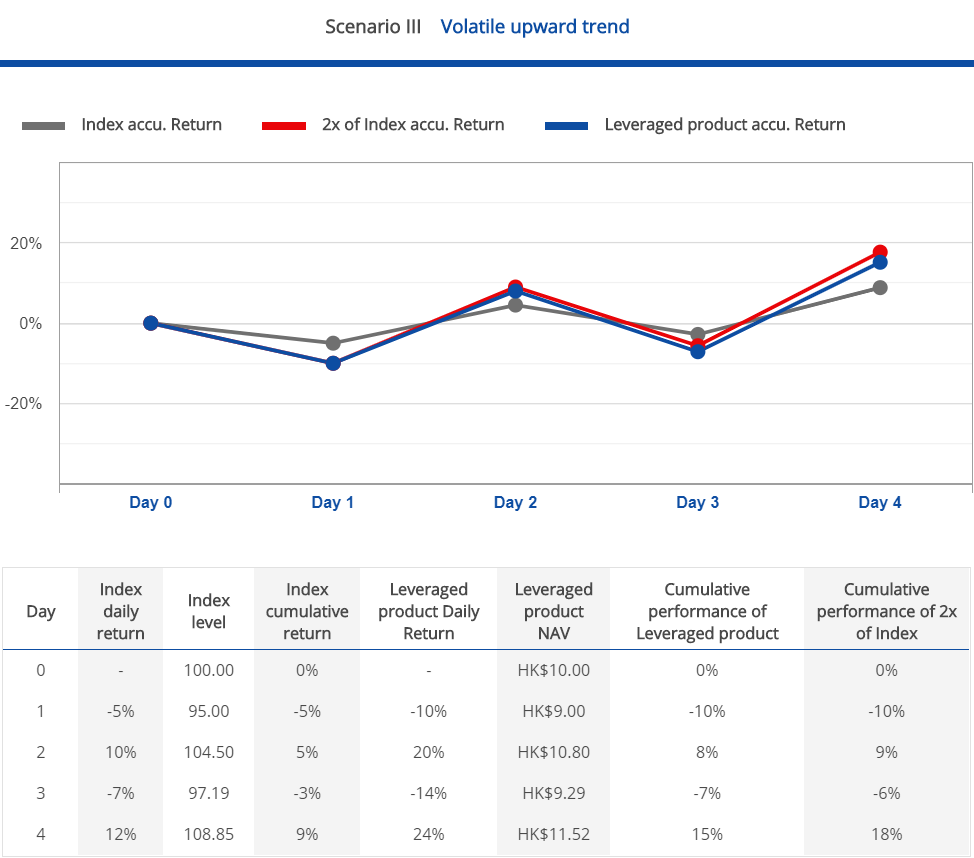

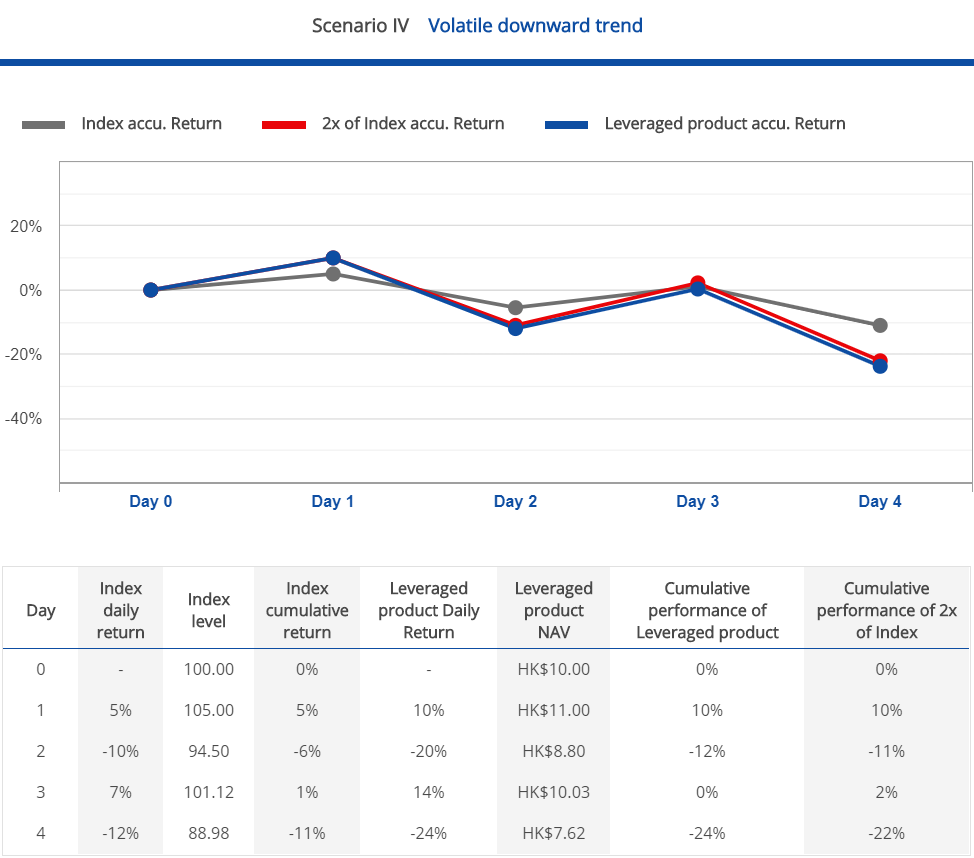

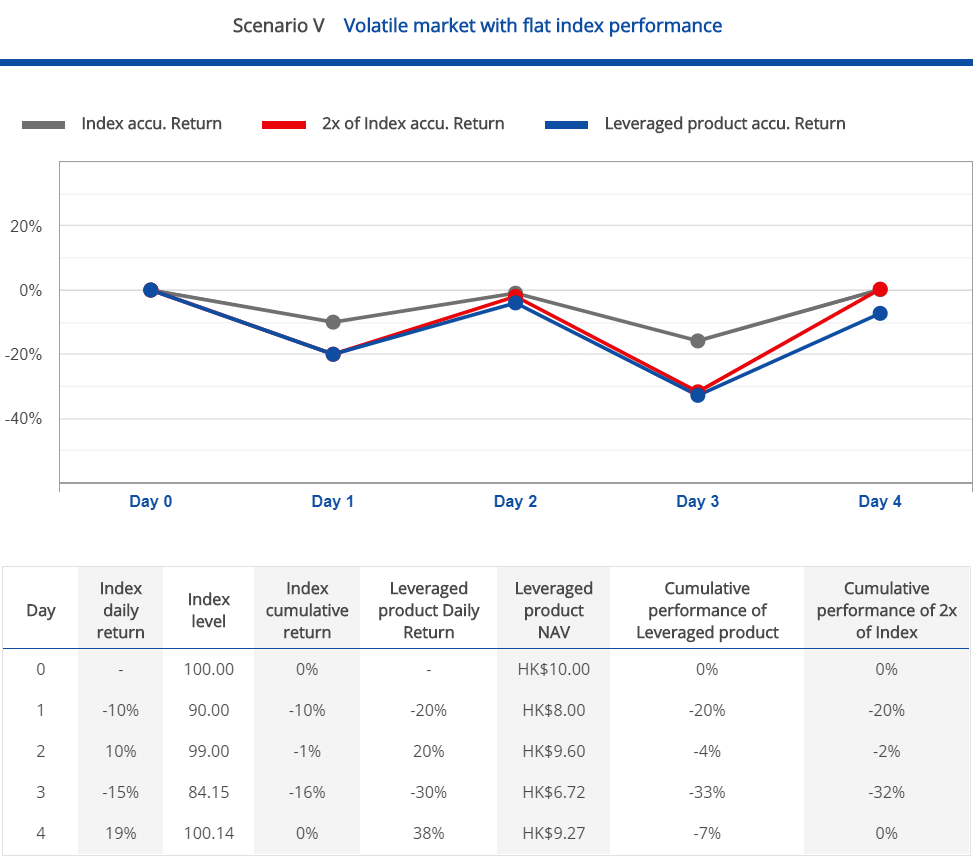

5 Case Study For Leveraged Product:

Comparison between the Index and the leveraged performance of the Index for a period longer than one day (i.e. comparison of the point-to-point performance).The Product‟s objective is to provide returns which are of a predetermined leverage factor (2x) of the daily performance of the Index. As such, the Product‟s performance may not track twice the cumulative Index return over a period greater than 1 Business Day. This means that the return of the Index over a period of time greater than a single day multiplied by 200% generally will not equal to the Product‟s performance over that same period. It is also expected that the Product will less than the return of 200% of the Index in a trendless or flat market. This is caused by compounding, which is the cumulative effect of previous earnings generating earning or losses in addition to the principal amount, and will be amplified by the volatility of the market and the holding period of the Product. In addition, the effects of volatility are magnified in the Product due to leverage. The following scenarios illustrate how the Product‟s performance may deviate from that of the cumulative Index return (2x) over a longer period of time in various market conditions. All the scenarios are based on a hypothetical $10 investment in the Product.

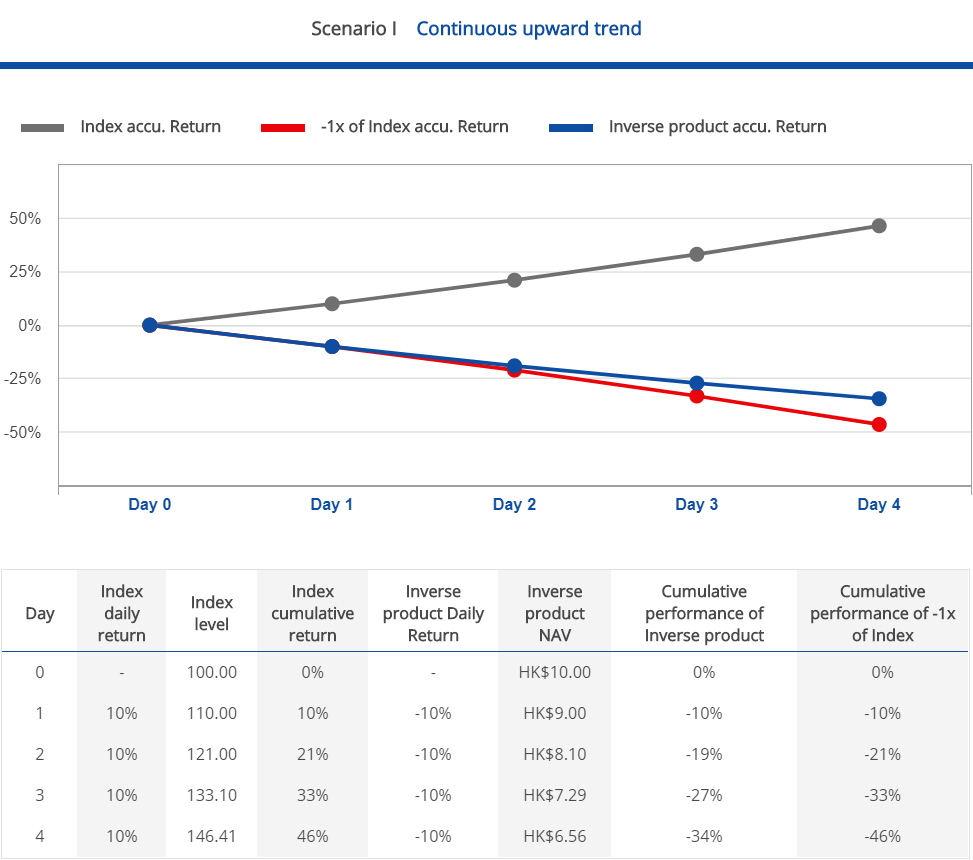

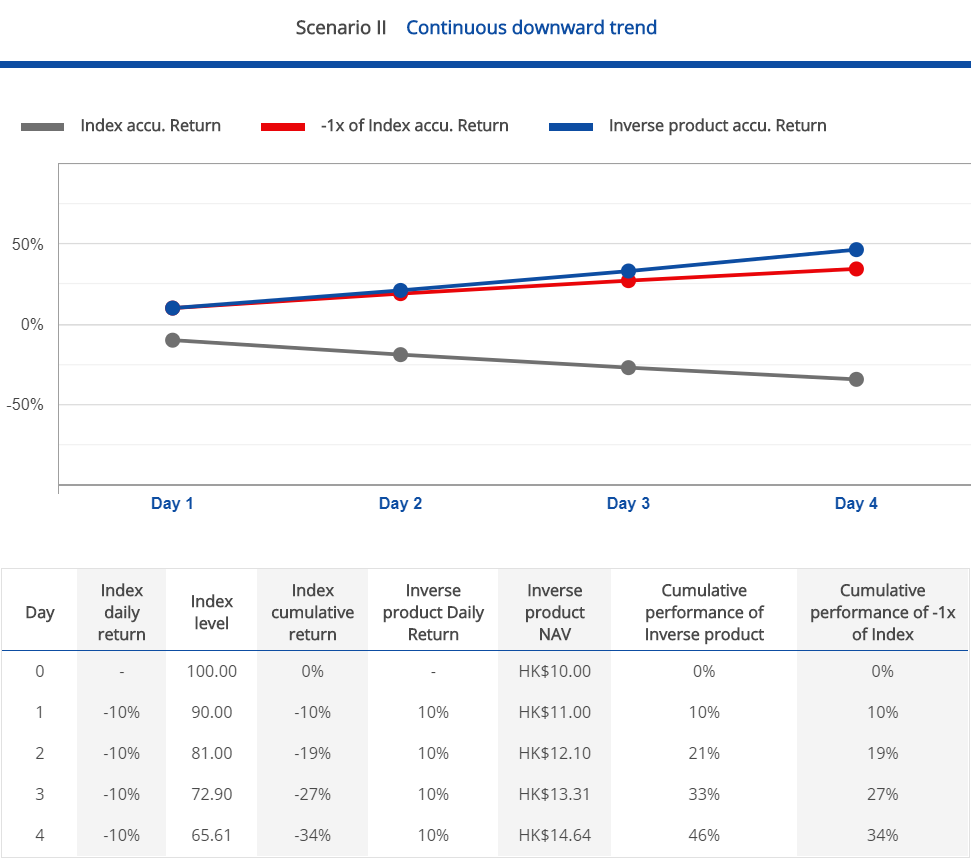

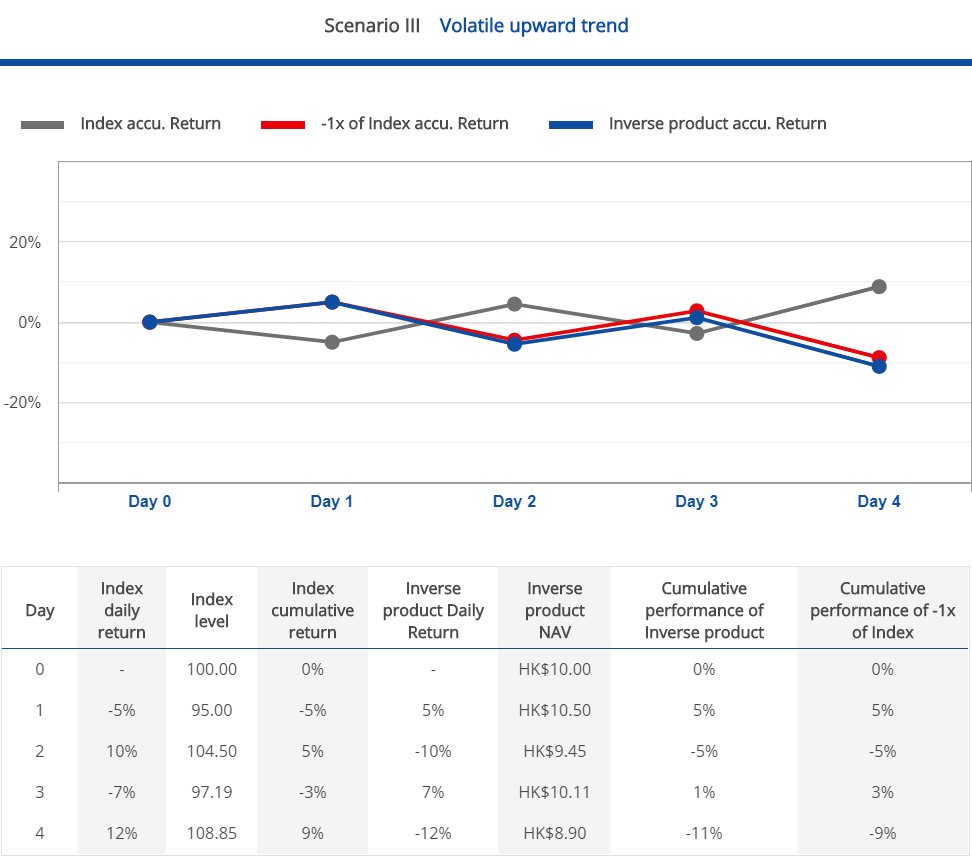

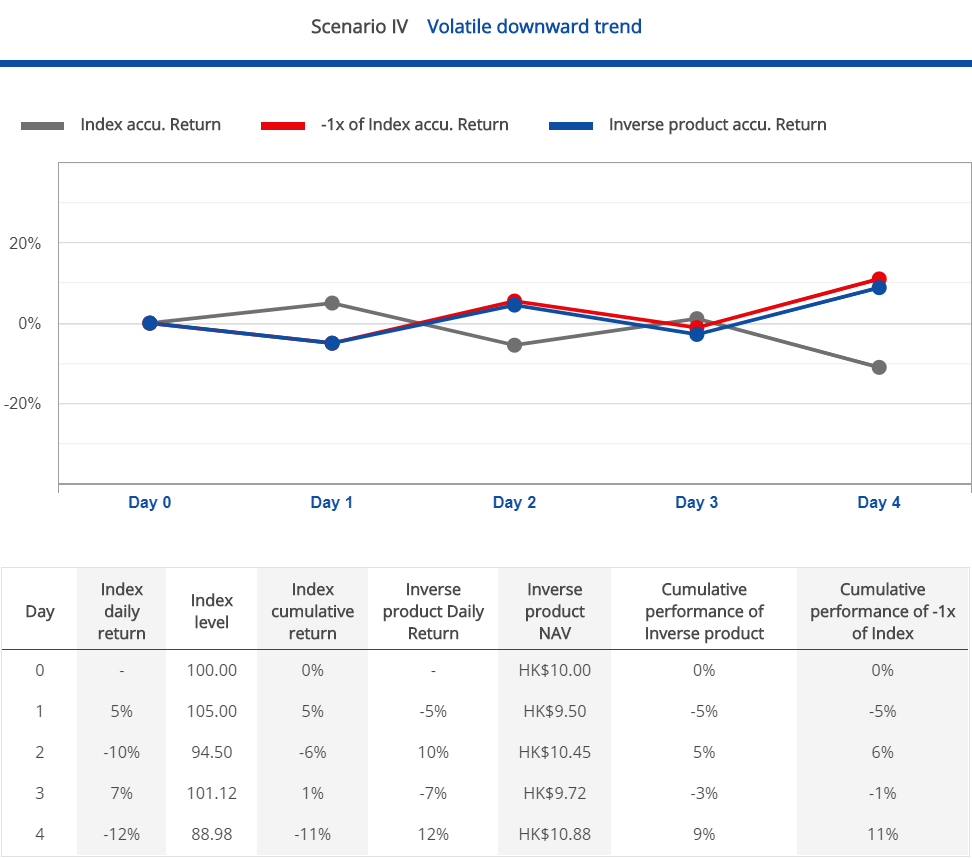

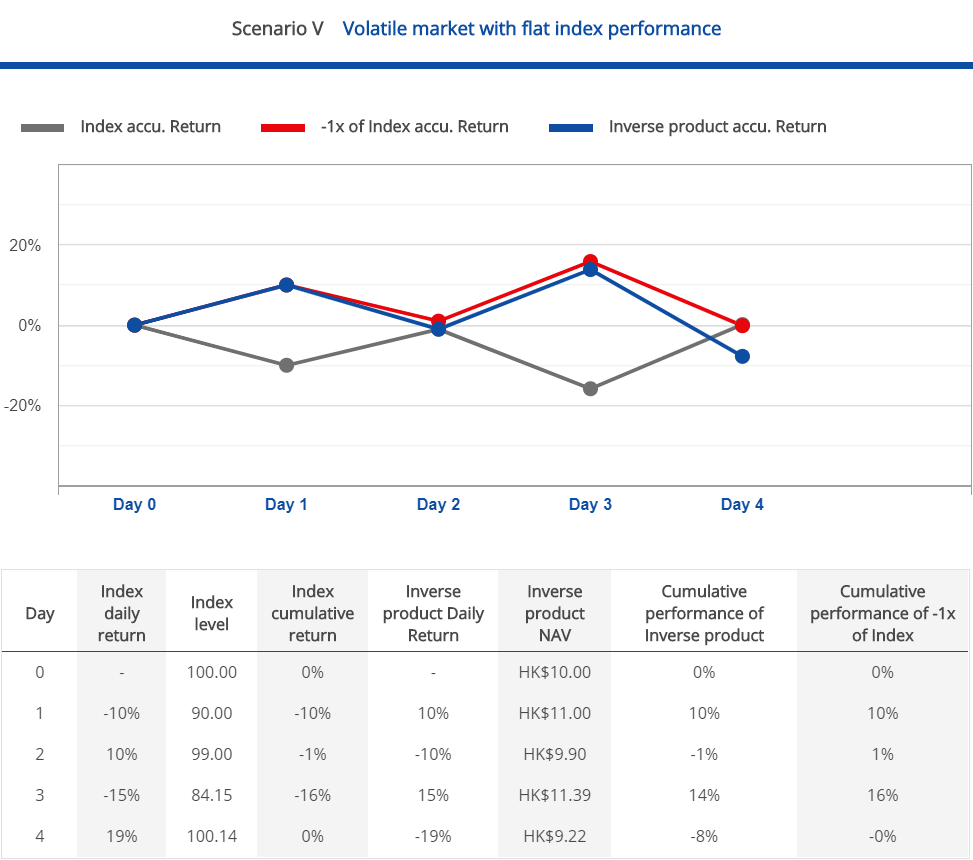

5 Case Study For Inverse Product:

Comparison between the Index and the inverse performance of the Index for a period longer than one day (i.e. comparison of the point-to-point performance). The Product‟s objective is to provide returns which are of a predetermined inverse factor (-1x) of the daily performance of the Index. As such, the Product‟s performance may not track -1x the cumulative Index return over a period greater than 1 Business Day. This means that the return of the Index over a period of time greater than a single day multiplied by -100% generally will not equal to the Product‟s performance over that same period. It is also expected that the Product will less than the return of -100% of the Index in a trendless or flat market. This is caused by compounding, which is the cumulative effect of previous earnings generating earning or losses in addition to the principal amount, and will be amplified by the volatility of the market and the holding period of the Product. The following scenarios illustrate how the Product‟s performance may deviate from that of the cumulative Index return (-1x) over a longer period of time in various market conditions. All the scenarios are based on a hypothetical $10 investment in the Product.

It is important for investors to understand that Leveraged/ Inverse products aim to provide returns for a specific time period.

The value of a Leveraged/ Inverse products with a daily reset will change by the percentage movement in its benchmark, multiplied by the leverage/inverse factor (2x, -1x), for a given day.

At the end of the day, the base value for future returns is "reset" and used as a starting point for the next day's returns. With Leveraged/ Inverse products, daily resets cause a compounding effect, whereby losses and gains from each period affect the base from which the next period's returns are calculated.

Below is a simple simulator to help investors better understand the returns provided by Leveraged/ Inverse products and the impact of the daily reset.

Index accu. Return

2x of Index accu. Return-1x of Index accu. Return

Leveraged product accu. ReturnInverse product accu. Return

-10%-8%-5%-3%0%3%5%8%10%

| Day | Index accu. Return | -1x of Index accu. Return | Inverse product accu. Return |

|---|

- Past performance is not indicative of future performance. Investors may not get back the full amount invested.

- Where no past performance is shown, there was insufficient data available for that period to provide performance.

- Investment involves risks. Please refer to the Prospectus and other offering documents for more information about the Product and the risks details.

- The figures used are for illustrative purpose only. Not indicative of actual return likely to be achieved.

1) Leveraged & Inverse Product vs Derivative

| Leveraged & Inverse Product | Warrants / CBBCs | Margin Trading | Futures | Options | |

|---|---|---|---|---|---|

| Accessibility | Cash or Margin Account | Cash or Margin Account | Margin Trading Account | Futures Account | Options Account |

| Possible Loss | Limited | Limited | Infinite | Infinite | Infinite |

| Margin Call | No | No | Yes | Yes | Yes |

| Leveraged Factor | 2x or -1x | 2x to 50x or above | 2x to 8x | Around 15x | 2x to 50x or above |

| Transparency | More | Less | More | More | Less |

2) What is Daily Rebalancing?

Leveraged product: At or around the close of the underlying TOPIX Futures/KRX KOSPI Futures market on each trading day in Tokyo/Korea, the Product will seek to rebalance its portfolio, by increasing exposure in response to the Index’s daily gains or reducing exposure in response to the Index’s daily losses, so that its daily leverage exposure ratio to the Index is consistent with the Product’s investment objectives.

The table below illustrates how the Product as a leveraged product will rebalance its position following the movement of the Index by the end of the day.* Assuming that the initial Net Asset Value of the Product is 100 on day 0, the Product will need to have a futures exposure of 200 to meet the objective of the Product. If the Index increases by 10% during the day, the Net Asset Value of the Product would have increased to 120, making the futures exposure of the Product 220. As the Product needs a futures exposure of 240, which is 2x the Product‟s Net Asset Value at closing, the Product will need to rebalance its position by an additional 20. Day 1 illustrates the rebalancing requirements if the Index falls by 5% on the subsequent day.

| Calculation | Day 0 | Day 1 | Day 2 | |

|---|---|---|---|---|

| (a) Initial Product NAV | 100 | 120 | 108 | |

| (b) Initial futures exposure | (b) = (a) × 2 | 200 | 240 | 216 |

| (c) Daily Index change (%) | 10% | -5% | -5% | |

| (d) Profit / loss on futures | d) = (b) × (c) | 20 | -12 | 10.8 |

| (e) Closing Product NAV | (e) = (a) + (d) | 120 | 108 | 118.8 |

| (f) Futures exposure | (f) = (b) × (1+(c)) | 220 | 228 | 226.8 |

| (g) Target futures exposure | (g) = (e) × 2 | 240 | 216 | 237.6 |

| (h) Required rebalancing amounts | (h) = (g) - (f) | 20 | -12 | 10.8 |

*The above figures are calculated before fees and expenses.

Inverse product: At or around the close of the underlying TOPIX Futures/KRX KOSPI Futures market on each trading day in Tokyo/Korea, the Product will seek to rebalance its portfolio, by decreasing exposure in response to the Index’s daily gains or increasing exposure in response to the Index’s daily losses, so that its inverse exposure ratio to the Index is consistent with the Product’s investment objectives.

The table below illustrates how the Product as an inverse product will rebalance its position following the movement of the Index by the end of the day.* Assuming that the initial Net Asset Value of the Product is 100 on day 0, the Product will need to have a futures exposure of -100 to meet the objective of the Product. If the Index decreases by 10% during the day, the Net Asset Value of the Product would have increased to 110, making the futures exposure of the Product -90. As the Product needs a futures exposure of -110, which is -1x the Product‟s Net Asset Value at closing, the Product will need to rebalance its position by an additional -20. Day 1 illustrates the rebalancing requirements if the Index increases by 5% on the subsequent day.

| Calculation | Day 0 | Day 1 | Day 2 | |

|---|---|---|---|---|

| (i) Initial Product NAV | 100 | 110 | 104.5 | |

| (j) Initial futures exposure | (b) = (a) × -1 | -100 | -110 | -104.5 |

| (k) Daily Index change (%) | -10% | 5% | -5% | |

| (l) Profit / loss on futures | (d) = (b) × (c) | 10 | -5.5 | 5.225 |

| (m) Closing Product NAV | (e) = (a) + (d) | 110 | 104.5 | 109.725 |

| (n) Futures exposure | (f) = (b) × (1+(c)) | -90 | -115.5 | -99.275 |

| (o) Target futures exposure | (g) = (e) × -1 | -110 | -104.5 | -109.73 |

| (p) Required rebalancing amounts | (h) = (g) - (f) | -20 | 11 | -10.45 |

*The above figures are calculated before fees and expenses

3) Compounding effect

Investment returns for periods longer than one day are affected by compounding. Daily compounding can have either a positive or negative effect on returns and daily compounded returns may not be equal to an unleveraged return (or the benchmark index) multiplied by the leveraged factor. The compounding effect increases with:

- Higher volatility

- Greater leverage, and

- Longer holding periods

IMPORTANT INFORMATION

Please read the following information carefully before proceeding

The corporate website address of Samsung Asset Management (Hong Kong) Limited has been changed from “www.samsungetf.com.hk” to “www.samsungetfhk.com” with effect from 30 April 2021.

The information contained in this website has been prepared to assist potential investors in making an informed decision in relation to investing in the ETFs / products under Samsung ETFs Trust and Samsung ETFs Trust II (collectively the “Trusts”) . A product key facts statement and prospectus for the ETFs / products under the Trusts which contain the key features and risks are also issued by the manager and available in this website.

The contents of this website have been prepared in good faith. However, the prices quoted are for reference only and may be subject to change without prior notice. Past performance is not a reliable indicator of future performance. The value of ETFs / products can fluctuate substantially within a short period of time. Samsung Asset Management (Hong Kong) Ltd has no warranty of accuracy or reliability is given and no responsibility arising in any way for errors or omissions.

An investment in any ETFs / products carries various risks. Each of these may affect the net asset value, yield, total return and trading price of the units. There can be no assurance that the investment objectives of Trusts will be achieved. You should carefully evaluate the merits and risks of an investment in the relevant ETFs / products in the context of your overall financial circumstances, knowledge and experience as an investor.

Samsung ETFs Trust and Samsung ETFs Trust II (collectively the “Trusts”) and each ETF / product under the Trusts are authorized by the Securities & Futures Commission in Hong Kong (the “SFC”) under Section 104 of the Securities and Futures Ordinance. However, the SFC takes no responsibility for the financial soundness of the ETFs / products under the Trusts or for the correctness of any statements made in this website. SFC authorization is not a recommendation or endorsement of a scheme nor does it guarantee the commercial merits of a scheme or its performance. It does not mean the scheme is suitable for all investors nor is it an endorsement of its suitability for any particular investor or class of investors.

You should consult your financial adviser, consult your tax advisers and take legal advice as appropriate as to whether any governmental or other consents are required, or other formalities need to be observed, to enable you to acquire units as to whether any taxation effects, foreign exchange restrictions or exchange control requirements are applicable and to determine whether any investment in the ETFs / products is appropriate for you.

For any questions or complaints, please contact the manager at its address as set out in the “Contact Us” or call the manager on +852-2115-8710 during normal office hours.

* Please click the “Accept” button below once you have read carefully the above important information and agree to abide by them.