Virtual Assets

What are virtual assets?

“Virtual assets” refers to a digital representations of value which may be in the form of digital tokens (such as cryptocurrencies, utility tokens or security or asset-backed tokens), any other virtual commodities, crypto assets or other assets of essentially the same nature, irrespective of whether they amount to “securities” or “futures contracts” as defined under the SFO, excluding digital expressed fiat currencies issued by central banks are excluded.

- Digital tokens examples

- Cryptocurrency: typically decentralized digital money designed to be used over the internet. The most popular cryptocurrencies are Bitcoin and Ether

- Utility tokens: a special type of crypto token designed for serving a particular use case in a concerned ecosystem. Basically, utility tokens grant the rights to users to perform some actions on a specific blockchain network or decentralized application.

- Non-Fungible Token (NFT): virtual assets that typically in the forms of digital art and collectibles

What is Bitcoin?

- Bitcoin is the world’s first widely-adopted cryptocurrency which was created in 2009 by Satoshi Nakamoto.

- Bitcoin is digital money that designed in a way that users can exchange value with one another directly through a peer-to-peer network which without a central intermediary such as bank or broker acting in the middle. This allows data to be shared and stored, or bitcoin payments to be sent and received seamlessly between parties.

- The Bitcoin network is completely public. Everyone in the world with an internet connection and a device can connect to the network and participate without restriction

How Bitcoin is created?

Bitcoins come into existence by the validation of transactions on the bitcoin network, through a process called mining. Those performing this validation are referred to as miners.

When miners successfully verify a group of transactions, they are awarded bitcoin for their work, as well as the transaction fees included with each transaction. Miners follow a set of cryptographic rules which keep the network stable, safe and secure.

Bitcoin transactions are recorded and verified on a digital public ledger called blockchain.

Source: CME Group, as of 30 Dec 2022

What is virtual asset futures ETF?

Virtual asset futures ETF are exchange-traded funds obtaining exposure to virtual assets primarily through futures contracts (such as bitcoin futures or ether futures traded on CME).

Virtual asset futures ETF is a derivative product and is targeted at investors with derivative knowledge.

The performance of virtual asset futures ETF can significantly deviate from that of the VA’s spot price, because the virtual asset futures ETF invests in VA futures but not in the VA directly.

Key risks of investing virtual asset futures ETF

- Risk related to the underlying VA

- Risks of rolling futures contracts

- Risk of volatility of a single asset or a single futures contract

- Liquidity risk

- Operational risks

Source: IFEC, as of 13 Dec 2022

Difference between VA futures and VA spot

| VA Spot | VA Futures | |

|---|---|---|

| Trading price | Spot price | Future price |

| Ownership of virtual assets | Direct ownership | No ownership |

| Capital requirement | Full value of the asset | Margin value of the futures |

| Trading platform/exchange | Virtual assets platform/exchange. such as Binance | Future exchange, such as Chicago Mercantile Exchange (CME) |

| History of underlying exchange | Shorter | Longer |

- Spot Price vs Future Price

- Spot price is the current price of an asset with payment being immediate and the buyer taking delivery immediately or within a few days

- Future price is the price of the asset at a future date, unlike spot price that refers to an asset's current price

- VA Spot vs VA Futures

- VA spot trading is the process of buying and selling digital assets such as Bitcoin and Ethereum for immediate delivery. In other words, cryptocurrencies are directly transferred between market participants (buyers and sellers). In a spot market, investors have direct ownership of cryptocurrencies and are entitled to legal rights such as voting for major forks or staking participation.

- For VA futures, investors are trading contracts that represent the value of specific virtual assets. When investors purchase a futures contract, they do not own the underlying assets. Instead, they own a contract with an agreement to buy or sell a specific cryptocurrency at a future date. Ownership of a futures contract does not reward investors with any economic benefits such as voting and staking

Risks involving investing in Bitcoin spot and VA

- New innovation risk

- Bitcoin is a relatively new innovation and the market for bitcoin is subject to rapid price swings, changes and uncertainty. It is not backed by any authorities, government or corporations. Continued further development of the Bitcoin Network and the acceptance and use of bitcoin are subject to a variety of factors that are difficult to predict or evaluate. Any cessation or reversal of such development of the Bitcoin Network or the acceptance of bitcoin may adversely affect the price of bitcoin

- Regulatory risk

- The regulation on bitcoin, digital assets and related products and services continues to evolve and increase. To the extent that future regulatory actions or policies limit or restrict bitcoin usage, bitcoin trading or the ability to convert bitcoin to fiat currencies, the demand for and value of bitcoin may be reduced significantly

- Price Volatility risk

- The price of virtual assets are driven by supply and demand and can be very volatile

- No guarantee or backing

- Virtual assets are generally not backed by physical assets or guaranteed by government or central bank

- Trading on less regulated venue risk

- Most virtual assets platform are not regulated and located overseas. The operations of these platforms are lack of transparency and investors may face potential total loss if these platforms cease operations

- Liquidity risk

- There may be lack of liquidity if there is not enough active buyers and sellers in the market

- Fraud & Cybersecurity risk

- Cyber-attacks resulting in the hacking of virtual asset trading platforms and thefts of virtual assets are common. Especially for the trading platform operators storing clients’ assets in hot wallets (cryptocurrency wallet that is always connected to the internet)

Source: Samsung Asset Management (HK) Limited, as of 30 Dec 2022

IFEC, as of 30 Nov 2022

SFC, as of 1 Nov 2018

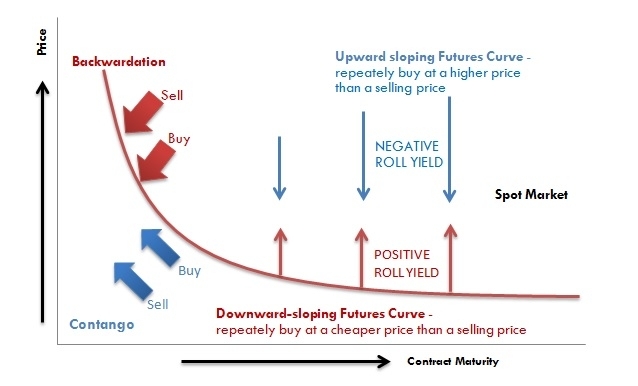

What are Contango / Backwardation?

- "Contango" is the process whereby near-month futures are cheaper than those expiring further into the future, creating an upward sloping curve for futures prices over time (i.e. Futures Price > Spot Price at contract maturity). In a contango environment, an investor who is long futures may experience "negative roll yield" if the contract is rolled after the futures price moves downward to converge with the expected spot price. Even if the commodity appreciates, the investor holding long futures may experience a loss

- "Backwardation" is opposite of contango, when near-month futures are more expensive than those expiring further into the future (i.e. Future Price < Spot Price at contract maturity). In a backwardation environment, an investor who is long futures may experience "positive roll yield" if the contract is rolled after the futures price rises to converge with the expected spot price. Even if the commodity appreciates, the investor holding long futures may experience no loss

Rollover effects

Rolling of futures contracts means selling existing futures contract that ar about to expire and replacing them with futures contract that will expire at a later date. If the prices of the longer-term contracts are higher than those of the expiring contracts (i.e. a contango market), the proceeds from selling the expiring contracts will not be sufficient to buy the same number of longer term contracts.

Potentially large roll cost will occur if the price of longer-term contracts is much higher than the price of existing futures contract

Here is a simple step-by-step Contango example using the table below:

| Day 0 |

the ETF enters into the 1st nearby futures contract at the level of 100. |

| 1 month later from Day 0 |

the ETF closes out the position by selling the 1st nearby futures contract at 110 then enters into the 2nd nearby futures contract at 113, i.e. the ETF has a negative roll yield of -3 from this rollover trade. |

| 2 month later from Day 0 |

the ETF closes out the position of selling 2nd nearby futures contract at 115. |

| Calculate the ETF profit from Day 0 |

When we calculate the profit of the ETF, we must take count negative rollover yield, -3. Therefore, the profit of the ETF is 115 – 100 – 3, which is 12. |

| Day 0 | 1 month later (rollover trade) | 2 months later | |

|---|---|---|---|

| 1st nearby futures | 100 | 110 | |

| 2nd nearby futures | 102 | 113 | 115 |

- Rolling of Futures Contracts risk: "Rolling" means selling existing futures contract that are about to expire and replacing them with futures contract that will expire at a later date. If the prices of the longer-term contracts are higher than those of the expiring contracts (i.e. a contango market), the proceeds from selling the expiring contracts will not be sufficient to buy the same number of longer term contracts. Given that the Sub-Fund (being a futures-based exchange traded fund) needs to rollover if needed, a loss may incur compared to the spot price performance (i.e. a negative roll yield) and would adversely affect the NAV. Investors should note that save for the transaction cost incurred, “rolling” in itself is not a loss or return-generating event. The roll yield is typically realised over time.

- Volatility risk: The price of futures contracts can be highly volatile and is influenced by, among others, trade, fiscal, monetary and exchange control programs and political changes.

- Leverage risk: Because of the low margin deposits normally required in futures trading, an extremely high degree of leverage is typical of a futures trading account. A relatively small price movement in futures may result in a proportionally high impact and substantial losses to the investors. A futures transaction may result in losses in excess of the amount invested.

- Mandatory measures imposed by relevant parties risk: Regarding to the futures positions, relevant parties (such as clearing brokers and execution brokers) may impose certain mandatory measures under extreme market circumstances. These measures may include limiting the size and number of the futures positions and/or mandatory liquidation of the futures positions without advance notice to the investors.