General

It has always been our top priorities to offer consistent investor education on a regular basis.

Let’s learn about ETF (Exchange Traded Funds) (1 minute reading)

- A Pooled investment vehicle that offers diversified exposure of a particular area /theme of markets.

- Across different asset classes: stocks, bonds, commodities, currencies, or a blend of assets.

- Like a mutual fund but can trade at stock exchange during trading hours as a normal stock.

- Passive ETFs are tracking the performance of underlying index

What kind of ETF can you choose? (2 minutes reading)

Index-based ETFs

- Aim to track underlying index’s performance

- Indices can be broad-based index such as Hang Seng Index, S&P 500 etc. or customized index such as thematic index or regional index

Commodity and currency ETFs

- Through Physicals assets or future markets to gain exposure in relevant assets.

- Commodity ETF includes oil ETFs, gold ETFs, silver ETFs etc.

- Currency ETF includes RMB ETF, USD ETF or HKD ETF in Hong Kong.

Leveraged Products

- Using futures or swap based to replicate the return.

- Attempt to produce a multiplier of the daily return of their underlying benchmark.

- Daily rebalancing, not suitable for holding more than one day.

Inverse Products

- Using futures or swap based to replicate the return

- Attempt to produce an inverse multiplier of the daily return of their underlying benchmark.

- Daily rebalancing, not suitable for holding more than one day.

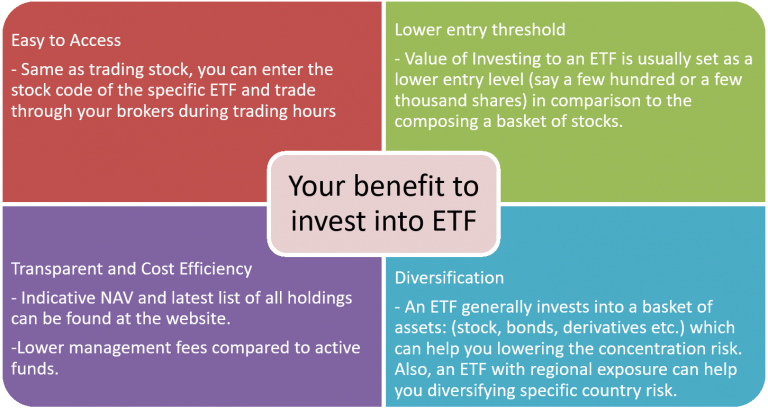

Your benefits of investing ETFs (1 minute reading)

Before investing ETFs, you may need to know... (1 minute reading)

Investment risk |

|

Currency risk |

|

|

|

| Same as any kind of investment, the price of the ETF may go up or down that may lead to gain or loss exposure. | An ETF may invest into different kinds of asset around the world so you may expose to currency risk. | |

Tax risk |

Liquidity risk |

|

|

|

|

| Tax will affect your return. ETF tax calculator at HKEX by clicking here can help you to know more about it. | Low Liquidity of ETF may lead to a higher average bid/ask spreads which may deviate largely from the indicative NAV. Investing into less developed market may increase the liquidity risk of the ETF. |

What do you need to pay to invest in an ETF? (1 minute reading)

Total Cost of ownership (TCO)* = Trading Costs + Holding Costs

*Source: HKEX, as of December 2017

How to trade ETF? (1 min reading)

- Through Hong Kong stock brokerage account.

- Buy or sell anytime during Hong Kong trading hours.

- T+2 settlement.

- Can use different kind of order strategies like market order, limit order and stop orders etc.

How can I know the price of the ETF? (2 min reading)

- You can buy or sell at market price. Market price refers to the Hong Kong Stock Exchange published price which you can find in the stock trading system provided by brokers or other market data providers.

- Indicative Net Asset Value (iNAV) provides an indicative value of the ETF and is calculated by a third party data provider updated every 15 seconds. Market price may deviate from iNAV due to the liquidity of the ETF and underlying assets in different time zone.

- iNAV can be found at the website of the ETF issuer.

- If there is a large deviation between the onscreen price and the iNAV, you are suggested to wait for a relatively closer iNAV price offered by Market makers.

- Market price is always traded at premium or discount. Premium means the market price is larger than the price of iNAV. Discount means the market price is lower than the price of iNAV.

- Daily NAV refers to the total value of all assets in the fund, including underlying assets, cash, subtracting any liabilities if any, and then dividend by the number of outstanding shares in the ETF after the market close.

What are Futures Based ETFs? (3 min reading)

A Futures-Based ETF is an ETF that utilizes exchange-traded futures contracts to track the movement of an underlying index. The idea to use futures contracts instead of physical assets to create ETFs initially started for commodities ETFs where holding physical assets would be difficult or unpractical for various reasons. By using futures, managers are able to create new products and exposures that were not possible under conventional schemes such as leveraged/inverse products, Moreover, by using futures contracts, one can create a single product with multiple exposures. For example, with futures contracts, a single product can be exposed to an equity index and foreign currency simultaneously.

All futures contracts traded on the Futures Exchange are registered, cleared and guaranteed by the Exchange or the Clearing House. As the Exchange or the Clearing House acts as the counterparty to all open contracts, futures-based ETFs have lower counterparty risk and are more transparent in terms of price compared with synthetic ETFs.

There is no stamp duty on futures trading in most markets including Hong Kong which can make futures-based ETF relatively cost efficient.

Unlike conventional ETFs that track an underlying index by investing in a basket of constituent shares, a future-based ETF invests in futures contract to achieve its investment objective. As such, risks that are not relevant to conventional ETFs may be present. They are mainly risks relating to futures contracts and may include leverage, liquidity and roll over risks. For the entire list of futures contract related risk, please refer to the "Important Information".

What is a Futures Contract? (3 min reading)

Futures contract is a contract between two parties where both parties agree to buy and sell a particular asset of specific quantity and at a predetermined price, at a specified date in future.

The payment and delivery of the asset is made on the future date termed as delivery date. The buyer in the futures contract is known as to hold a long position or simply long. The seller in the futures contracts is said to be having short position or simply short.

The underlying asset in a futures contract could be commodities, stocks, currencies, interest rates and bond. The futures contract is held at a recognized stock exchange. The exchange acts as mediator and facilitator between the parties. In the beginning both the parties are required by the exchange to put beforehand a nominal account as part of contract known as the margin.

Compared to conventional Securities, futures contracts can be more sensitive to changes in interest rates or to sudden fluctuations in market prices due to both the low margin deposits required, and the extremely high degree of leverage involved in their pricing.

The futures contracts markets generally may be uncorrelated to the traditional markets and are subject to greater risks than other markets.

It is a feature of futures contracts generally that they are subject to rapid change and the risks involved may change relatively quickly. The price of futures contracts can be highly volatile. Such price movements are influenced by, among other things, interest rates, changing market supply and demand relationships, trade, fiscal, monetary and exchange control programs and policies of governments. In some cases, far-reaching political changes may result in constitutional and social tensions, instability and reaction against market reforms.

Since the futures prices are bound to change every day, the differences in prices are settled on daily basis from the margin. If the margin is used up, the contractee has to replenish the margin back in the account. This process is called marking to market. Thus, on the day of delivery it is only the spot price that is used to decide the difference as all other differences had been previously settled.

What is a Margin? (5 min reading)

A margin in the futures market is the amount of cash an investor must put up to open an account to start trading. This cash amount is the initial margin requirement and it is not a loan. It acts as a down payment on the underlying asset and helps ensure that both parties fulfil their obligations. Both buyers and sellers must put up payments.

Initial Margin

The initial margin is the initial amount of cash that must be deposited in the account to start trading contracts. It acts as a down payment for the delivery of the contract and ensures that the parties honour their obligations.

Maintenance Margin

The maintenance margin is the balance a trader must maintain in his or her account as the balance changes due to price fluctuations. It is some fraction - perhaps 75% - of initial margin for a position. If the balance in the trader's account drops below this margin, the trader is required to deposit enough funds or securities to bring the account back up to the initial margin requirement. Such a demand is referred to as a margin call. The trader can close his position in this case but he is still responsible for the loss incurred. However, if he closes his position, he is no longer at risk of the position losing additional funds.

Margin Call

A margin call is a request from a brokerage firm to a trader to bring margin deposits up to the initial margin levels in order to keep holding the current positions. A margin call normally happens with an adverse move against the trader's positions. If the value of the account falls below the maintenance margin level, a margin call will be triggered and the broker will require the trader to deposit more funds in order to hold the positions. If funds are not received in the requested time, the broker will likely liquidate enough positions to eliminate the margin call.

Numerical Example (Below table is for illustration purpose only)

| Price of a Futures Contract

$10,000 |

Initial Margin | Maintenance Margin

$900 |

|||

| Price Fluctuation | Contract Value | Current Margin Level | Margin Call | Top up Amount | Margin Level after Margin Call |

|---|---|---|---|---|---|

| 0% | $10,000 | $1,000 | No | 0 | $1,000 |

| -5% | $9,500 | $500 | Yes | $500 | $1,000 |

| -10% | $9,000 | $0 | Yes | $1,000 | $1,000 |

| -15% | $8,500 | $0 | Yes | $1,500 | $1,000 |

| -20% | $8,000 | $0 | Yes | $2,000 | $1,000 |

| -25% | $7,500 | $0 | Yes | $2,500 | $1,000 |

| -30% | $7,000 | $0 | Yes | $3,000 | $1,000 |

All margin requirements must be settled in cash or by the lodgement of approved debt securities, approved securities or such other non-cash collateral as may be approved by the Exchange Board from time to time. For these purposes, a cheque received by an Exchange Participant in good faith which the Exchange Participant has no reason for suspecting will not be honoured on first presentation may be treated as cash.

What are some of the effects of roll-over on the index and the ETF price? (1 min reading)

As the Futures Contracts (e.g. WTI Futures contracts) included in the Index come to expiration, they are replaced by contracts that have a later expiration. For example, a contract purchased and held in September may specify an October expiration. As time passes, the contract expiring in October is replaced by a contract for delivery in November. This is accomplished by selling the October contract and purchasing the November contract. This process is referred to as "rolling".

The rolling keeps an investor fully invested. The roll return will be positive when the futures curve is downward sloping ("backwardation") or negative when the futures curve is upward sloping ("contango")

Can you show an illustrated example of the effects of a roll-over? (3 min reading)

Here is a simple step-by-step Contango example using the table below:

| Day 0 |

the ETF enters into the 1st nearby futures contract at the level of 100. |

| 1 month later from Day 0 |

the ETF closes out the position by selling the 1st nearby futures contract at 110 then enters into the 2nd nearby futures contract at 113, i.e. the ETF has a negative roll yield of -3 from this rollover trade. |

| 2 month later from Day 0 |

the ETF closes out the position of selling 2nd nearby futures contract at 115. |

| Calculate the ETF profit from Day 0 |

When we calculate the profit of the ETF, we must take count negative rollover yield, -3. Therefore, the profit of the ETF is 115 – 100 – 3, which is 12. |

| Day 0 | 1 month later (rollover trade) | 2 months later | |

|---|---|---|---|

| 1st nearby futures | 100 | 110 | / |

| 2nd nearby futures | 102 | 113 | 115 |

(The table is for explanatory purpose only and prepared by Samsung Asset Management (HK) Ltd.)