Important Note

- The ETF aims to provide investment results that, before fees and expenses, closely correspond to the performance of the S&P High Yield Asia Pacific-Ex New Zealand REITs Select Index (Net Total Return) (“Index”).

- Investment involves risk, including the loss of principal. Investors should refer to the prospectus of Samsung S&P High Dividend APAC ex NZ REITs ETF (the “ETF”) for details, including the risk factors. Investors should not base investment decisions on this material alone. Historical performance does not indicate future performance.

- The ETF could be subject to certain key risks such as risks of Asia Pacific market real estate sector concentration risks; Risk associated with investments in REITs; Real estate sector risk; Asia Pacific market risks; New index risks; Other currency distribution risks; Multi-counter risks, etc. Please note that the above listed investment risks are not exhaustive.

- The Manager may at its discretion pay distributions out of capital, or effectively out of capital, of the ETF, amounting to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment, resulting in an immediate reduction of the NAV per unit

Product Video

Income opportunities in a low interest rate environment during inflation

- Protection against inflation remains one of the major investment themes

- High dividend yield REIT remains an attractive fixed income asset class as there is still significant spread between high dividend REITs and treasury yield

- Underlying index is comprised of 30 REITs listed in developed markets across Asia Pacific (excluding New Zealand) with the highest trailing 12-month dividend yield

- 3187.HK aims to pay out dividend quarterly, subject to Manager's discretion

- Most of the Asia REITs are required to pay out at least 90% of their net earnings as dividend. Thus, the income streams that REITs generate are relatively stable

REITs as inflation hedge

- REITs are natural hedge against inflation as value of real estate is expected to increase when inflation rises

- Real estate rents and values tend to increase during inflation

- APAC REITs have higher dividend rate than the consumer price index in recent years

Why investing into Asia REITs ?

- Captures Asia economic recovery opportunities

- Asia REITs have a lower correlation with other assets. Include Asia REITs in your portfolio can achieve effective diversification

- REITs generally have higher dividend rates than stocks and long-term bonds, providing investors with considerable passive income

3187 / 9187 - The First REITs ETF in Hong Kong#

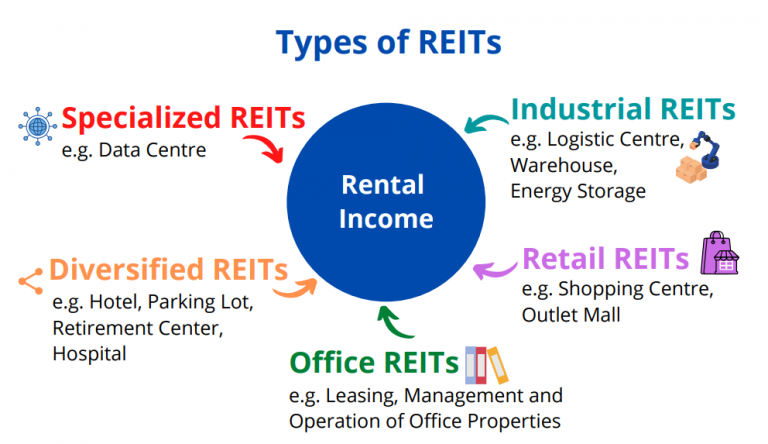

- One stop REITs solution - Currently investing into developed Asia REITs. Besides traditional REITs including residential, shopping center, office and hotel, the ETF is also investing into REITs with relatively low correlation to traditional economy such as data center, logistics center and retirement center.

- Easily invest in different Asia-Pacific markets - ETF invests in different markets in Asia-Pacific (excluding New Zealand), including but not limited to Hong Kong, Singapore, Australia, Japan, etc., to help investors capture interest-earning opportunities in the Asia-Pacific market.

- Relative Low Investment threshold – You can invest into a basket of Asia REITs with relative low investment amount

- Potential dividend opportunity - Quarterly (in March, June, September and December) subject to Manager's discretion.

# Source: Samsung Asset Management (Hong Kong) Limited, as of 31 May 2023 *Source: Bloomberg, as of 30 Jun 2024