Important Note

- Samsung Bitcoin Futures Active ETF (“Sub-Fund”) is a sub-fund of Samsung ETFs Trust III. The investment objective of the Sub-Fund is to provide economic exposure to the value of Bitcoin by investing predominately in front-month Chicago Mercantile Exchange (“CME”) Bitcoin Futures contracts. The Sub-Fund does not invest directly in Bitcoin and will not receive any Bitcoin from Bitcoin Futures on CME. There is no assurance that the Sub-Fund will achieve its investment objective.

- Investment involves risk, including the loss of principal. Historical performance does not indicate future performance.

- This Sub-Fund is an active futures-based exchange traded fund which is subject to risks associated with (i) derivatives; (ii) extreme price volatility risk; (iii) potential large roll costs of Bitcoin Futures on CME; and (iv) operational risks related to Bitcoin Futures on CME (such as margin risk and mandatory measures imposed by relevant parties risk) and is different from conventional exchange traded funds.

- The Sub-Fund could be subject to certain key risks such as General investment risk; Active investment management risk; Bitcoin risks (including New innovation risk; Unforeseeable risks; Price volatility risk; Risk relating to the limited history of bitcoin and Bitcoin Futures on CME; Risk of trading on less regulated venues; Fraud, market manipulation and security failure risk; Changes in acceptance of bitcoin; Regulatory risk; Fork risk; Air drop risk; Contagion risk, etc.); Bitcoin futures risks (including Market risk; Liquidity risk; Bitcoin futures capacity risk; Rolling of futures contracts risk and contango risk; Risk of material non-correlation with spot/current market price of bitcoin; Mandatory measures imposed by relevant parties risk; Price limit risk; Leverage risk; Exchange’s clearing house’s failure risk, etc.); New product risk; Concentration risk; Other currency distributions risks; Distributions out of or effectively out of capital risks; Trading risks; Trading hours differences risks; Reliance on market maker and liquidity risks; Termination risks.

- Please note that the above listed investment risks are not exhaustive. Investors should refer to the prospectus and relevant documents for details, including the product features, dividend policy and risk factors. Investors should not base on this material alone to make investment decisions.

- The Manager may at its discretion pay distributions out of capital, or effectively out of capital, of the ETF, amounting to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment, resulting in an immediate reduction of the NAV per unit.

- The Sub-Fund has been authorized by the Securities and Futures Commission (“SFC”). Authorization by the SFC does not imply official recommendation. This material is for reference only and does not constitute an offer or suggestion of any transaction in any products.

- This material is prepared by Samsung Asset Management (Hong Kong) Limited and has not been reviewed by the SFC. If you are in any doubt about the content of this material, please refer to the prospectus, product key facts statement and other relevant documents for details, and seek for independent financial advice when necessary.

- The original language of this document is English. In case of discrepancies between the Chinese/English translations, the English version shall prevail. The English version is published at www.samungetfhk.com. (This website has not been reviewed by the SFC)

Uniqueness of Bitcoin

The first and the largest cryptocurrency

Bitcoin is the world’s first widely-adopted virtual asset which was created in 2009, the very first blockchain technologies application

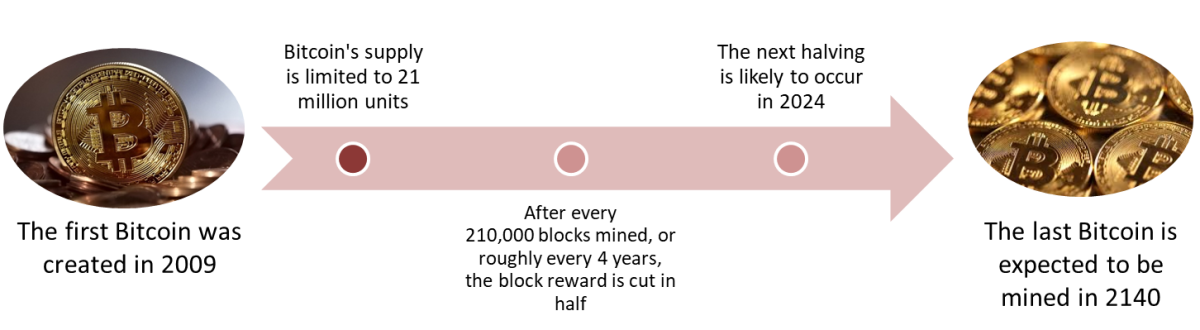

Bitcoin Halving

An event when the reward from mining Bitcoin transactions is cut in half

Bitcoin Halving History

| Reward per block before halving | Reward per block after halving | BTC price on Halving day (in USD) | BTC price 1 year after Halving (in USD) | |

| 2012 Halving | 50 BTC | 25 BTC | $12 | $1013 |

| 2016 Halving | 25 BTC | 12.5 BTC | $648 | $2502 |

| 2020 Halving | 12.5 BTC | 6.25 BTC | $8572 | $56764 |

| 2024 Halving | 6.25 BTC | 3.125 BTC | $64990 | ? |

Source: Data using Bitstamp BTC price from Tradingview price , as of 22 Apr 2024

Note difference on various exchange prices. This table is a rough estimate only

Returns are for reference only and past performance is not indicative of future returns

Institutional investors started to gain cryptocurrency exposure

Institutional investors start to participate in cryptocurrency investment

- BlackRock, the world's biggest asset manager, has formed a partnership with publicly traded crypto exchange Coinbase (COIN) to make crypto directly available to institutional investors*

- Nasdaq (NDAQ), the second-largest U.S. stock market operator, is starting a cryptocurrency custody service as it aims to cash in on the demand from institutional crypto investors**

Source: *Coindesk, as of 4 Aug 2022

** Coindesk, as of 21 Sep 2022

Bitcoin futures

There are futures contracts on bitcoin. Among bitcoin futures traded on conventional regulated exchanges, the most traded are bitcoin futures and ether futures on Chicago Mercantile Exchange (CME).

CME Bitcoin futures provide an efficient tool to access bitcoin exposure and pursue risk-management on the exposure. On CME, bitcoin futures contract is USD-denominated and cash settled. The contract unit of the bitcoin futures is 5 bitcoins. CME also offers micro bitcoin futures which have smaller contract units (0.1 bitcoin).

When investors buy and sell Bitcoin futures contracts, they are speculating about bitcoin’s future price. The price movement of Bitcoin spot and Bitcoin futures in general tend to be similar.

Bloomberg, as of 30 Dec 2022

Why Samsung Bitcoin Futures Active ETF

- Provide economic exposure to the value of Bitcoin by investing predominately in front-month Bitcoin futures contracts traded on the Chicago Mercantile Exchange (“CME”)

- We are experienced in investing in CME futures and managing active ETF

- Easy tool for investors to track the future price of Bitcoin which is the largest cryptocurrency in market capitalization. Investors do not need to create your cryptocurrency wallet or open futures account. You can trade the ETF through the Hong Kong stock account

- HKD as trading currency

- We hold strong belief in technology and launched a series of thematic ETF to provide investors with a simple tool to invest in the cutting-edge themes, including semiconductor sector, blockchain technology and APAC (ex NZ) metaverse

What does Samsung Bitcoin Futures Active ETF invest

Samsung Bitcoin Futures Active ETF seeks to provide economic exposure to the value of bitcoin by investing predominately in front-month Bitcoin Futures on CME. The Sub-Fund does not invest directly in bitcoin and will not receive any bitcoin from Bitcoin Futures on CME. There is no assurance that the Sub-Fund will achieve its investment objective.

.png)