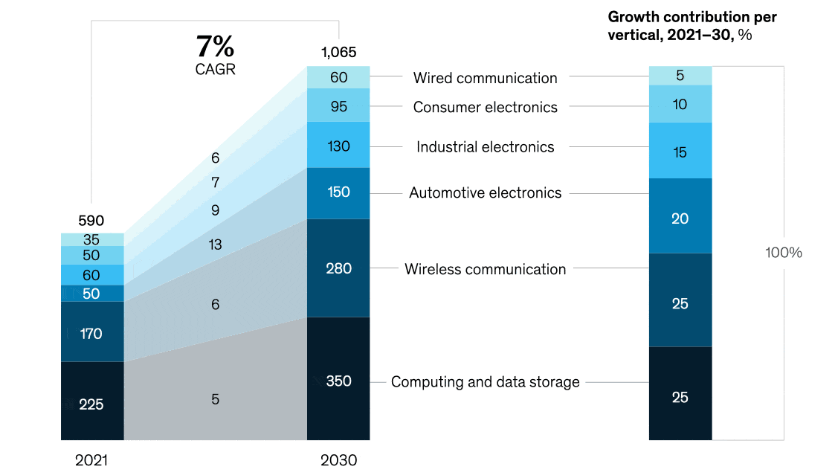

The global semiconductor market is expected to grow at a compound annual growth rate of 7 %, driven primarily by the automotive, data storage, and wireless communications industries.[2] driven primarily by the automotive, data storage, and wireless communications industries

[3] Source: Bloomberg, 30 Jun 2024

Please read the following information carefully before proceeding

Important Information

Please read the following information carefully before proceeding

The information contained in this website has been prepared to assist potential investors in making an informed decision in relation to investing in the ETFs / products under Samsung ETFs Trust, Samsung ETFs Trust II and Samsung ETFs Trust III (collectively the “Trusts”). A product key facts statement and prospectus for the ETFs / products under the Trusts which contain the key features and risks are also issued by the manager and available in this website.

The contents of this website have been prepared in good faith. However, the prices quoted are for reference only and may be subject to change without prior notice. Past performance is not a reliable indicator of future performance. The value of ETFs / products can fluctuate substantially within a short period of time. Samsung Asset Management (Hong Kong) Ltd has no warranty of accuracy or reliability is given and no responsibility arising in any way for errors or omissions.

Investment in any ETFs / products carries various risks. Each of these may affect the net asset value, yield, total return and trading price of the units. There can be no assurance that the investment objectives of Trusts will be achieved. You should carefully evaluate the merits and risks of an investment in the relevant ETFs / products in the context of your overall financial circumstances, knowledge and experience as an investor.

Samsung ETFs Trust, Samsung ETFs Trust II and Samsung ETFs Trust III (collectively the “Trusts”) and each ETF / product under the Trusts are authorized by the Securities & Futures Commission in Hong Kong (the “SFC”) under Section 104 of the Securities and Futures Ordinance. However, the SFC takes no responsibility for the financial soundness of the ETFs / products under the Trusts or for the correctness of any statements made in this website. SFC authorization is not a recommendation or endorsement of a scheme nor does it guarantee the commercial merits of a scheme or its performance. It does not mean the scheme is suitable for all investors nor is it an endorsement of its suitability for any particular investor or class of investors. This website and information contained in this website have not been reviewed by the SFC.

You should not invest in the ETFs/ products solely based on the information provided herein and should read the relevant ETFs/ products offering documents carefully before making any investment decision. You should consult your financial adviser, consult your tax advisers and take legal advice as appropriate as to whether any governmental or other consents are required, or other formalities need to be observed, to enable you to acquire units as to whether any taxation effects, foreign exchange restrictions or exchange control requirements are applicable and to determine whether any investment in the ETFs / products is appropriate for you.

For any questions or complaints, please contact the manager at its address as set out in the “Contact Us” or call the manager on +852-2115-8710 during normal office hours.

* Please click the “Accept” button below once you have read carefully the above important information and agree to abide by them.

Accept

* Please click the “Accept” button below once you have read carefully the above important information and agree to abide by them.