Commodity

Hong Kong's first crude oil ETF. Are you seeking for a convenient way to invest in the crude oil market?

Get started with SAMSUNG S&P GSCI Crude Oil ETF.

Tracking the oil “spot” price (meaning the prices quoted for immediate payment and delivery of particular physical commodity) implies physical ownership of the commodities and a number of associated costs such as delivery, storage and insurance.

The oil “spot” price which investors see on Bloomberg or quoted in the news is by definition not an investable return. As a result, investors throughout the world, and also ETFs, use liquid and standardized futures contracts to get exposure to the oil market. Standardised futures contracts imply delivery costs of pre-specified deliverable grades, at a particular location.

Overview about the Crude-Oil Market

What is Crude-oil?

Crude oil is a naturally occurring, unrefined petroleum product composed of hydrocarbon deposits and other organic materials. Crude oil can be refined to produce usable products such as gasoline, diesel and various forms of petrochemicals. It is a nonrenewable resource, also known as a fossil fuel, which means that it can't be replaced naturally at the rate we consume it and is therefore a limited resource.

Crude-Oil Supply

Crude oil production by the Organization of the Petroleum Exporting Countries (OPEC) is an important factor that affects oil prices. This organization seeks to actively manage oil production in its member countries by setting production targets. Historically, crude oil prices have seen increases in times when OPEC production targets are reduced.

Organization of the Petroleum Exporting Countries (OPEC): OPEC member countries produce about 40 percent of the world's crude oil. Equally important to global prices, OPEC's oil exports represent about 60 percent of the total petroleum traded internationally. Because of this market share, OPEC's actions can, and do, influence international oil prices. In particular, indications of changes in crude oil production from Saudi Arabia, OPEC's largest producer, frequently affect oil prices. The extent to which OPEC member countries utilize their available production capacity is often used as an indicator of the tightness of global oil markets, as well as an indicator of the extent to which OPEC is exerting upward influence on prices. OPEC spare capacity provides an indicator of the world oil market's ability to respond to potential crises that reduce oil supplies. As a result, oil prices tend to incorporate a rising risk premium when OPEC spare capacity reaches low levels. Markets are influenced by geopolitical events within and between OPEC countries because they have, historically, resulted in reductions in oil production. Given OPEC's market significance, events that entail an actual or future potential loss of oil supplies can produce strong reactions in oil prices.

Non-OPEC: Oil production from countries outside the Organization of the OPEC currently represents about 60 percent of world oil production. Key centers of non-OPEC production include North America, regions of the former Soviet Union, and the North Sea.

In contrast to OPEC oil production, which is subject to central coordination, non-OPEC producers make independent decisions about oil production. Also, in contrast to OPEC, where oil production is mostly in the hands of national oil companies (NOCs), international or investor-owned oil companies (IOCs) perform most of the production activities in non-OPEC countries. IOCs seek primarily to increase shareholder value and make investment decisions based on economic factors. While some NOCs operate in a similar manner as IOCs, many have additional objectives such as providing employment, infrastructure, or revenue that impact their country in a broader sense. As a result, non-OPEC investment, and thus future supply capability, tends to respond more readily to changes strictly in market conditions.

Producers in non-OPEC countries are generally regarded as price takers, that is, they respond to market prices rather than attempt to influence prices by managing production. As a result, non-OPEC producers tend to produce at or near full capacity and so have little spare capacity.

Crude-oil Demand

OECD: OECD consists of the United States, much of Europe, and other advanced countries. At 53 percent of world oil consumption in 2010, these large economies consume more oil than the non-OECD countries, but have much lower oil consumption growth. Oil consumption in the OECD countries actually declined in the decade between 2000 and 2010, whereas non-OECD consumption rose 40 percent during the same period.

Structural conditions in each country's economy influence the relationships among oil prices, economic growth, and oil consumption. Developed countries tend to have higher vehicle ownership per capita. Because of this, oil use within the OECD transportation sector usually accounts for a larger share of total oil consumption than in non-OECD countries; it is also more mature and slower-growing. Economic conditions and policies that affect the transport of goods and people thus have a significant impact on total oil consumption in OECD countries. Many OECD countries have higher fuel taxes and policies to improve the fuel economy of new vehicles and increase the use of biofuels. This tends to slow the growth in oil consumption even in times of strong economic growth. Furthermore, the economies in OECD countries tend to have larger service sectors relative to manufacturing. As a result, strong economic growth in these countries may not have the same impact on oil consumption as it would in non-OECD countries.

OECD countries tend to have fewer subsidies on end-use prices, so changes in market oil prices are often quickly reflected in prices faced by consumers. However, it takes time for people to adjust their transportation routines and for the vehicle stock to turn over and become more energy-efficient in response to price changes.

Changes in expected future oil prices also affect consumers' decisions concerning modes of transportation and vehicle purchases. If prices are expected to remain high or increase in the future, more consumers may decide to purchase more fuel efficient vehicles or use public transportation. Decisions like these help to reduce future oil demand and would tend to moderate expected price increases.

Non-OECD: Oil consumption in developing countries that are not part of the OECD has risen sharply in recent years. While oil consumption in the OECD countries declined between 2000 and 2010, non-OECD oil consumption increased more than 40 percent. China, India, and Saudi Arabia had the largest growth in oil consumption among the countries in the non-OECD during this period.

Rising oil consumption reflects rapid economic growth in these countries. Current and expected levels of economic growth heavily influence global oil demand and oil prices. Commercial and personal transportation activities, in particular, require large amounts of oil and are directly tied to economic conditions. Many manufacturing processes consume oil as fuel or use it as feedstock, and in some non-OECD countries, oil remains an important fuel for power generation. Because of these uses, oil prices tend to rise when economic activity and in turn oil demand is growing strongly. Many non-OECD countries are also experiencing rapid growth in population, which is an additional factor supporting strong oil consumption growth.

Structural conditions in each country's economy further influence the relationship between oil prices and economic growth. Developing countries tend to have a greater proportion of their economies in manufacturing industries, which are more energy intensive than service industries. Although transportation oil use is usually a smaller share of total oil consumption in non-OECD countries, this use tends to increase rapidly as expanding economies increase the need to move goods and people. Vehicle ownership per capita is also highly correlated with rising incomes and has much room to grow in non-OECD countries. For these reasons, non-OECD economic growth rates tend to be an important factor affecting oil prices. China's strong economic growth has recently resulted in that country becoming the largest energy consumer and second largest oil consumer in the world. In addition, China's rising oil consumption has been a major contributor to incremental growth in worldwide oil consumption. EIA projects that virtually all the net increase in oil consumption in the next 25 years will come from non-OECD countries.

Although oil use is clearly tied to economic activity, energy policies also significantly affect that relationship. Many developing countries, for example, control or subsidize end-use prices, which inhibits consumer response to market price changes. This reduced demand response to price changes further contributes to the importance of economic growth as a key driver of non-OECD demand and in turn global oil prices.

Crude-oil Prices

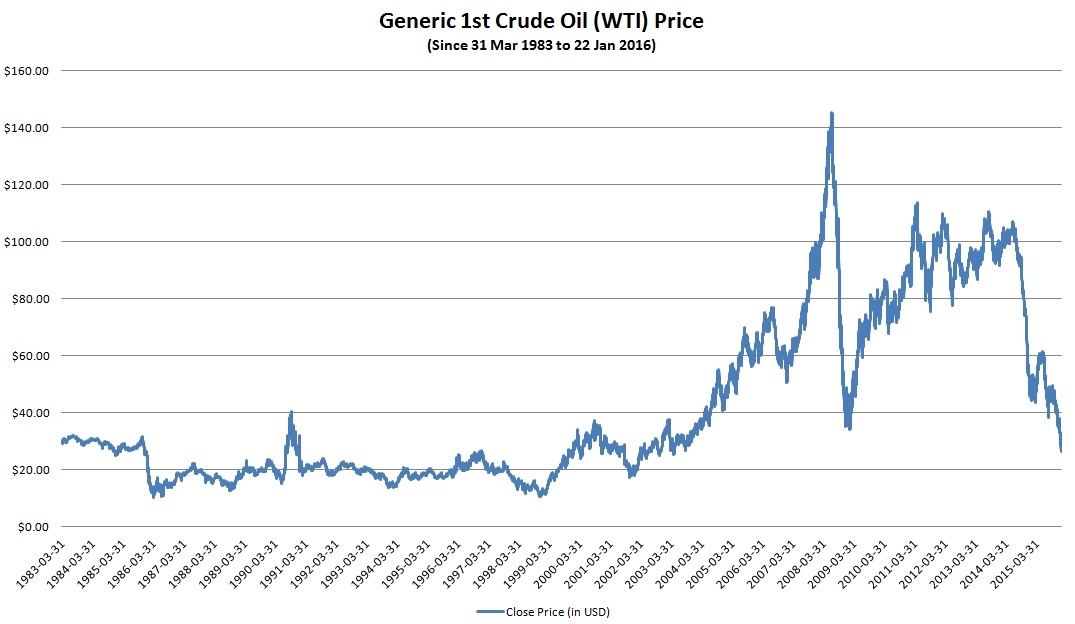

Crude oil prices measure the spot price of various barrels of oil, most commonly either the West Texas Intermediate or the Brent Blend. The OPEC basket price and the NYMEX futures price are also sometimes quoted.

West Texas Intermediate (WTI) crude oil is of very high quality because it is light-weight and has low sulphur content. For these reasons, it is often referred to as "light, sweet" crude oil. These properties make it excellent for making gasoline. That's why it is the major benchmark of crude oil in the Americas.

Brent Blend is a combination of crude oil from 15 different oil fields in the North Sea. It is less "light" and "sweet" than WTI, but still excellent for making gasoline. It is refined in Northwest Europe and is the primary benchmark for other crude oils in Europe or Africa.

As crude oil is traded in a global market, prices of the many crude oil streams produced globally tend to move closely together, although there are persistent differentials between light-weight, low-sulfur (light-sweet) grades and heavier, higher-sulfur (heavy-sour) crudes that are lower in quality.

Both crude oil and petroleum product prices can be affected by events that have the potential to disrupt the flow of oil and products to market, including geopolitical and weather-related developments. These types of events may lead to actual disruptions or create uncertainty about future supply or demand, which can lead to higher volatility in prices. The volatility of oil prices is inherently tied to the low responsiveness or "inelasticity" of both supply and demand to price changes in the short run. Both oil production capacity and the equipment that use petroleum products as their main source of energy are relatively fixed in the near-term. It takes years to develop new supply sources or vary production, and it is very hard for consumers to switch to other fuels or increase fuel efficiency in the near- term when prices rise. Under such conditions, a large price change can be necessary to re-balance physical supply and demand following a shock to the system.

Much of the world's crude oil is located in regions that have been prone historically to political upheaval, or have had their oil production disrupted due to political events. Several major oil price shocks have occurred at the same time as supply disruptions triggered by political events, most notably the Arab Oil Embargo in 1973-74, the Iranian revolution and Iran-Iraq war in the late 1970s and early 1980s, and Persian Gulf War in 1990. More recently, disruptions to supply (or curbs on potential development of resources) from political events have been seen in Nigeria, Venezuela, Iraq, Iran, and Libya.

Given the past history of oil supply disruptions emanating from political events, market participants are always assessing the possibility of future disruptions and their potential impacts. In addition to the size and duration of a potential disruption, they also consider the availability of crude stocks and the ability of other producers to offset a potential supply loss. For example, if the market has ample spare production capacity to offset a possible disruption, its likely impact on prices would be smaller than if spare production capacity was much lower. When there are significant concerns about the potential for a disruption at a time when spare capacity and inventories are not seen as sufficient to substantially offset the associated loss in supply, prices may be above the level that might be expected if only current demand and supply were considered, as forward-looking behavior adds a "risk premium."

Weather can also play a significant role in oil supply. Hurricanes in 2005, for example, shut down oil and natural gas production as well as refineries. As a result, petroleum product prices increased sharply as supplies to the market dropped. Severely cold weather can strain product markets as producers attempt to supply enough of the product, such as heating oil, to consumers in a short amount of time, resulting in higher prices. Other events such as refinery outages or pipeline problems can restrict the flow of oil and products, driving up prices.

However, the influence of these types of factors on oil prices tends to be relatively short lived. Once the problem subsides and oil and product flows return to normal, prices usually return to previous levels.

Oil Price & Financial Market

Market participants not only buy and sell physical quantities of oil, but also trade contracts for the future delivery of oil and other energy derivatives. One of the roles of futures markets is price discovery, and as such, these markets play a role in influencing oil prices.

Oil market trading activity involves a range of participants with varying motivations, even within individual participants. Some, such as oil producers and airlines, have a significant commercial exposure to changes in the price of oil and petroleum-based fuels, and may seek to hedge their risk by buying and selling energy derivatives. For example, an airline may want to buy futures or options in order to avoid the possibility that its future fuel costs will rise above a certain level, while an oil producer may want to sell futures in order to lock in a price for its future output.

Banks, hedge funds, commodity trading advisors, and other money managers who often do not have interests in trading physical oil are also active in the market for energy derivatives to try to profit from changes in prices. In recent years, investors have also shown interest in adding energy and other commodities as alternatives to equity and bond investments to diversify their portfolios or to hedge inflation risks.

Banks, hedge funds, and other "non-commercial" investors can add liquidity to futures and derivative markets by taking the other side of transactions with commercial participants. On the other hand, concerns have been raised that non-commercial commodity trading and investment may amplify price movements, particularly at times when momentum is running strongly in a particular direction.

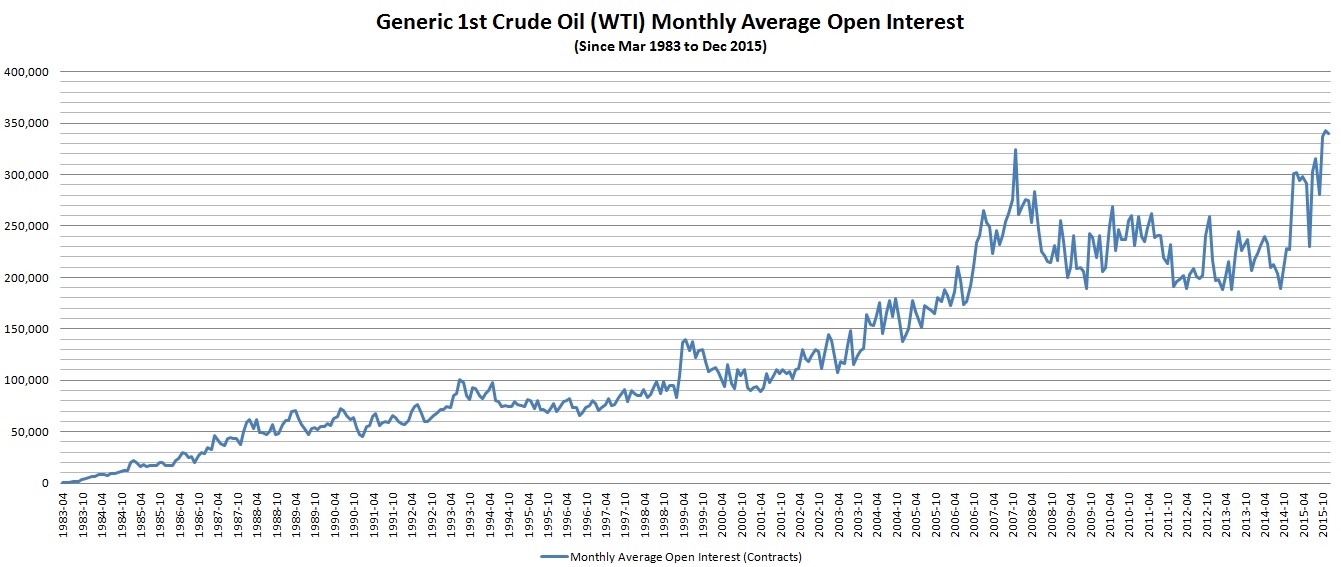

Activity in commodity exchange contracts has risen in recent years. One measure of activity in futures markets is open interest on exchanges, which indicates the number of contracts in a trading session that have not been settled or closed.

What index does the product use?

The Sub-fund uses "S&P GSCI Crude Oil Multiple Contract 55/30/15 1M/2M/3M (USD) Excess Return Index " ("Excess Return" does not mean any additional return on the Sub-Fund's performance), which tracks the performance of the WTI Futures Contracts with the closest expiration date (the "nearest contract") as benchmark. The return of the Index is calculated based on the change in price levels of all of the 1M Forward Contract, 2M Forward Contract, 3M Forward Contract and (during the rolling period only) 4M Forward Contract.

The index was launched on 15 June 2020 and had a base value of 100 as at 16 January 1995.

What are some of the effects of roll-over on the index and the ETF price?

As the WTI Futures Contracts included in the Index come to expiration, they are replaced by contracts that have a later expiration. For example, a contract purchased and held in September may specify an October expiration. As time passes, the contract expiring in October is replaced by a contract for delivery in November. This is accomplished by selling the October contract and purchasing the November contract. This process is referred to as "rolling".

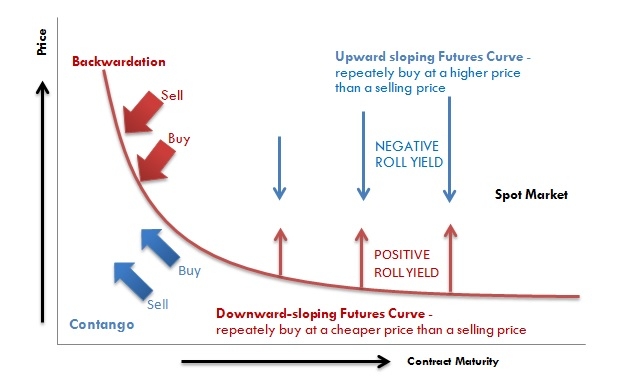

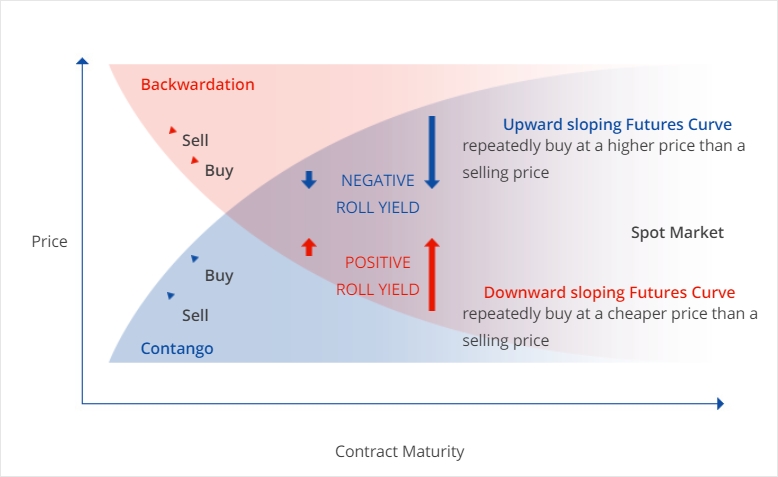

The rolling keeps an investor fully invested. The roll return will be positive when the futures curve is downward sloping ("backwardation") or negative when the futures curve is upward sloping ("contango").

When does the Sub-fund have roll-over trading? And how does it take place?

The Index includes provisions for the replacement (also referred to as "rolling") of the nearest contracts as they approach maturity. The rolling of a nearest contract occurs over a 5 day period every month, commencing on the 5th S&P GSCI Business Day of the month, and ending on the 9th S&P GSCI Business Day of the month.

For example, on 5 May 2016 (4th business day of the month), the Sub-Fund will hold 100% June 2016 contracts, which is the first nearby contract. For the avoidance of doubt, the last trading day of the first nearby contract is the 4th business day prior to the 25th calendar day each month. On 6 May 2016, which is the first day of roll-over being the 5th business day of the month, the Sub-Fund will hold 20% July 2016 contracts and 80% June 2016 contracts. On 9 May 2016, the Sub-Fund will hold 40% July 2016 contracts and 60% June 2016 contracts. In the following two business days, the Sub-Fund will increase its holding of July 2016 contracts by 20% each business day while decreasing its holding of June 2016 contracts by the same amount until, at the end of 12 May 2016, which is the final day of the roll-over (9th business day of the month), the Sub-Fund will hold 100% July 2016 contract.

What are the implications of contango and backwardation?

"Contango" is the process whereby near-month futures are cheaper than those expiring further into the future, creating an upward sloping curve for futures prices over time (i.e. Futures Price > Spot Price at contract maturity). In a contango environment, an investor who is long futures may experience "negative roll yield" if the contract is rolled after the futures price moves downward to converge with the expected spot price. Even if the commodity appreciates, the investor holding long futures may experience a loss.

"Backwardation" is opposite of contango, when near-month futures are more expensive than those expiring further into the future (i.e. Future Price < Spot Price at contract maturity). In a backwardation environment, an investor who is long futures may experience "positive roll yield" if the contract is rolled after the futures price rises to converge with the expected spot price. Even if the commodity appreciates, the investor holding long futures may experience no loss.

WTI crude oil has at times in the past traded in contango due to material storage costs of oil, as well as high demand of crude oil. Because roll yields are considered in the calculation of the Index, the presence of contango in the commodity markets could result in negative "roll yields", which could adversely affect the level of the Index.

Contango and/or backwardation are caused by many factors such as:

Carrying Costs

It consists of financial, storage, and insurance costs which are required to store the relevant commodity. Some commodities, such as natural gas and crude oil, are known for exhibiting steep contango over time as the carrying costs associated are relatively high.

Market supply and demand of the delivery month

E.G. For agricultural products, during September in the harvest season when shipment of the harvests takes place, the expected increase of supply influences the drop in price. If the expected supply is to increase, backwardation occurs where futures price is lower than the spot price.

Convenience yield

It refers to the non-monetary earnings from raw material inventory

Irregular market movements

An inverted market, the holding of an underlying good or security may become more profitable than owning the contract or derivative instrument, due to its relative scarcity versus high demand.

Any factors leading to contango or backwardation?

Contango and/or backwardation are caused by many factors such as:

Carrying Costs

Carrying costs consist of financial, storage, and insurance costs which are required to store the relevant commodity. Some commodities, such as natural gas and crude oil, are known for exhibiting steep contango over time as the carrying costs associated are relatively high compared with other commodities.

Market supply and demand of the delivery month

For agricultural products, during September in the harvest season when shipment of the harvests takes place, the expected increase of supply influences the drop in price. If the expected supply is to increase, backwardation occurs where futures price is lower than the spot price.

Convenience yield

Convinience yield refers to a benefit or premium with holding raw material inventory, rather than the contract or derivative product. It stems from the availability of timely physical delivery. In an inverted market, the holding of an underlying good or security may become more profitable than owning the contract or derivative instrument, due to its relative scarcity versus high demand.

Can you show an illustrated example of the effects of a roll-over?

Here is a simple step-by-step Contango example using the table below:

| Day 0 |

the ETF enters into the 1st nearby futures contract at the level of 100. |

| 1 month later from Day 0 |

the ETF closes out the position by selling the 1st nearby futures contract at 110 then enters into the 2nd nearby futures contract at 113, i.e. the ETF has a negative roll yield of -3 from this rollover trade. |

| 2 month later from Day 0 |

the ETF closes out the position of selling 2nd nearby futures contract at 115. |

| Calculate the ETF profit from Day 0 |

When we calculate the profit of the ETF, we must take count negative rollover yield, -3. Therefore, the profit of the ETF is 115 – 100 – 3, which is 12. |

| Day 0 | 1 month later (rollover trade) |

2 months later |

|

|---|---|---|---|

| 1st nearby futures | 100 | 110 | |

| 2nd nearby futures | 102 | 113 | 115 |

(The table is for explanatory purpose only and prepared by Samsung Asset Management (HK) Ltd.)

What are the differences between Spot and S&P GSCI Crude Oil Index ER?

As the S&P GSCI Crude Oil Index ER(Excess Return does not mean any additional return on the Sub-Fund's performance) is based upon WTI Futures Contracts but not on physical WTI crude oil, the performance of the Index may differ from the current market or spot price performance of the WTI crude oil. The price movements of a futures contract are typically correlated with the movements of the spot price of the referenced commodity, but the correlation is generally imperfect and price movements in the spot market may not be reflected in the futures market (and vice versa).

For example:

During the one-year period from 1 January 2009 to 31 December 2009, the Index underperformed the spot price of WTI crude oil by 71% (the level of the Index increased by 7%, while the spot price of crude oil increased by 78%).

Large differences between the spot price and the futures price can exist because the market is always trying to look ahead to predict what prices will be. Futures prices can be either higher or lower than spot prices, depending on the outlook for supply and demand of the asset in the future.

You can find historical performance of Spot and ER indices at this link

Price

Contract Maturity

Backwardation

Sell

Buy

Sell

Buy

Contango

NEGATIVE

ROLL YIELD

POSITIVE

ROLL YIELD

Upward sloping Futures Curve

repeatedly buy at a higher price

than a selling price

Downward sloping Futures Curve

repeatedly buy at a cheaper price than

a selling price

Spot Market

"Contango" is the process whereby near-month futures are cheaper than those expiring further into the future, creating an upward sloping curve for futures prices over time (i.e. Futures Price > Spot Price at contract maturity). In a contango environment, an investor who is long futures may experience “negative roll yield” if the contract is rolled after the futures price moves downward to converge with the expected spot price. Even if the commodity appreciates, the investor holding long futures may experience a loss.

“Backwardation” is opposite of contango, when near-month futures are more expensive than those expiring further into the future (i.e. Future Price < Spot Price at contract maturity). In a backwardation environment, an investor who is long futures may experience “positive roll yield” if the contract is rolled after the futures price rises to converge with the expected spot price. Even if the commodity appreciates, the investor holding long futures may experience no loss.

As the WTI Futures Contracts included in the Index come to expiration, they are replaced by contracts that have a later expiration. For example, a contract purchased and held in September may specify an October expiration. As time passes, the contract expiring in October is replaced by a contract for delivery in November. This is accomplished by selling the October contract and purchasing the November contract. This process is referred to as “rolling”.

The rolling keeps an investor fully invested. The roll return will be positive when the futures curve is downward sloping (“backwardation”) or negative when the futures curve is upward sloping (“contango”).

Example of the effects of a rollover

Here is a simple step-by-step Contango example using the table below:

Example of the effects of a rollover

Here is a simple step-by-step Contango example using the table below:

| Day 0 |

the ETF enters into the 1st nearby futures contract at the level of 100. |

| 1 month later from Day 0 |

the ETF closes out the position by selling the 1st nearby futures contract at 110 then enters into the 2nd nearby futures contract at 113, i.e. the ETF has a negative roll yield of -3 from this rollover trade. |

| 2 month later from Day 0 |

the ETF closes out the position of selling 2nd nearby futures contract at 115. |

| Calculate the ETF profit from Day 0 |

When we calculate the profit of the ETF, we must take count negative rollover yield, -3. Therefore, the profit of the ETF is 115 – 100 – 3, which is 12. |

| Day 0 | 1 month later (rollover trade) |

2 months later |

|

|---|---|---|---|

| 1st nearby futures | 100 | 110 | / |

| 2nd nearby futures | 102 | 113 | 115 |

(The table is for explanatory purpose only and prepared by Samsung Asset Management (HK Ltd.)